Let’s Talk Mortgage Amortizations

Buying a home is an exciting time whether you are purchasing your first home, upsizing, or downsizing. However, choosing the mortgage that is right for you can also feel daunting. Once you have determined how much you are willing and able to spend on a home, and found the perfect home, you need to decide what amortization period is best for your needs and budget.

The Key Differences Between Short and Long Amortizations

There are several key differences between short amortization periods ( 10 or 15 years) and long amortization periods (25 or 30 years) that you should consider when choosing the mortgage amortization period for you.

Short Amortizations

One of the main benefits of having a shorter amortization period is that you spend less time paying down your mortgage, so you are mortgage free faster. This also means that you will pay less interest overall and build equity in your home more quickly. Home equity is the portion of your home that you truly own, and is calculated by taking the amount your house is currently worth and subtracting how much you still owe on your mortgage.

Having a shorter amortization period also helps you better take advantage of low interest rates. For example, if you are able to get a 25 year amortization on a fixed rate mortgage at 2.99% for the first term (typically 5 years), but the rate increases to 4.99% when you go to renew it then your monthly payments will increase accordingly, and you will end up paying more interest than you may have initially planned. If you chose a 5 year amortization period, then you would pay the lower 2.99% interest rate for the entire length of your mortgage. However, you would have significantly higher minimum payments.

Mortgages with short amortization periods are a great option for individuals who are trying to pay off their mortgage as fast as possible, but it is important to keep in mind that by setting a short amortization you are setting a higher contractual minimum payment and reducing payment flexibility within your mortgage. As an alternative to having a short amortization, simply use your prepayment privileges (typically 15-20%) to accomplish the same thing without handcuffing yourself with higher minimum payments. It is important to remember that it is your payments that determine your amortization. So, simply pay more and you will reduce your amortization and save interest.

Long Amortizations

The main benefit of choosing a mortgage with a longer amortization period is lower monthly mortgage payments. This can be a huge benefit if your income fluctuates month to month, if you are carrying a large mortgage, or if you are buying your first home. Longer amortization periods can also make it easier for you to buy a more expensive home because they can help you get approved for a larger mortgage.

Mortgages with longer amortization periods are good because they allow you to minimize risk. Since your monthly payments are lower with a longer amortization period If you lose your job or become too ill to work the payments will be more manageable than if you had the higher monthly payments associated with a shorter amortization mortgage.

Many first time homebuyers find that shorter amortization mortgages put a lot of stress on their finances. Until you are actually living in your house and know what your other home-related monthly bills are (heating, electricity, etc.), it can be difficult to know precisely how much money you can afford to put towards your monthly mortgage payments. Again, you can always pay more, but you cannot pay less than the minimum contractual payment. A longer amortization period means lower monthly payments, and gives you more financial breathing room that can be used to cover non-mortgage related household expenses.

A longer amortization period can also help you achieve your homeownership dreams while also prioritizing other higher interest debt, such as credit cards or contribute more money to your retirement fund or living expenses.

Shortening Your Amortization Period

If a longer amortization period makes the most sense for you when you first purchase your home, but your financial situation changes, you can always shorten your amortization. As mentioned, you can simply increase your payments or make a lump sum payment towards the mortgage principal. Also, when the mortgage comes up for renewal, you can further reduce the amortization. Shortening your amortization period or making a lump sum payment reduces the amount of interest you will end up paying overall and allows you to become mortgage free sooner.

30-Year Amortizations (Are They Coming Back)?

Over the past couple of years, the CMHC instituted new rules that state that homebuyers with less than a 20% down payment can now only have a maximum amortization period of 25 years. That means that if you want to get a mortgage with a 30 year amortization period, you won’t be able to get mortgage insurance, and you can typically only get a 30-year mortgage if you can put forward at least 20% of the home’s cost as a down payment or have 20% equity in your current property.

Though restricted to certain types of mortgages, 30-year amortizations are becoming increasingly popular. Part of the drive behind the increased interest in “extended amortization” mortgages is the fact that while home prices have risen substantially over the last decade, the income of the average Canadian has not kept pace. This means that many individuals who wish to become first-time homebuyers may not be able to afford the monthly payments associated with mortgages with even 25 year amortization periods.

Canadians are also carrying more debt than ever, a trend that is fueled by student loans, the rising cost of living, and poor spending habits. This means that many Canadians are already saddled with large amounts of debt, reducing the amount of money they have each month to put towards a mortgage.

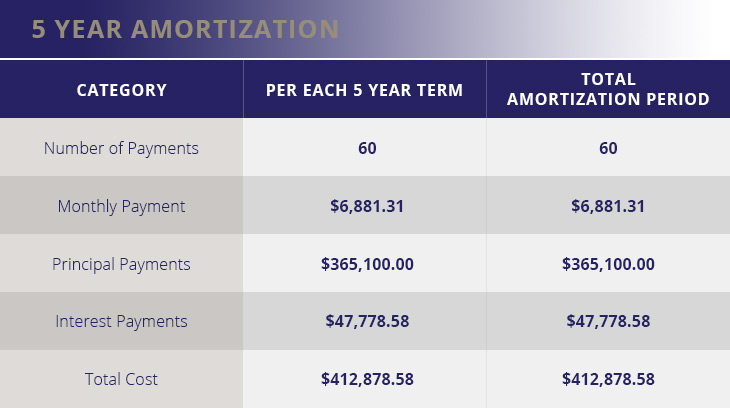

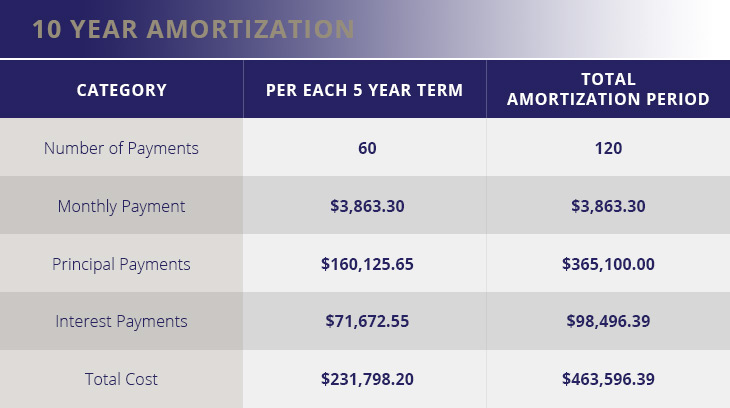

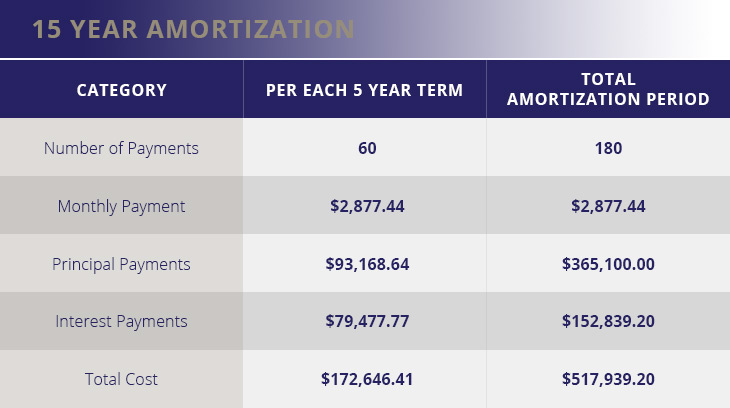

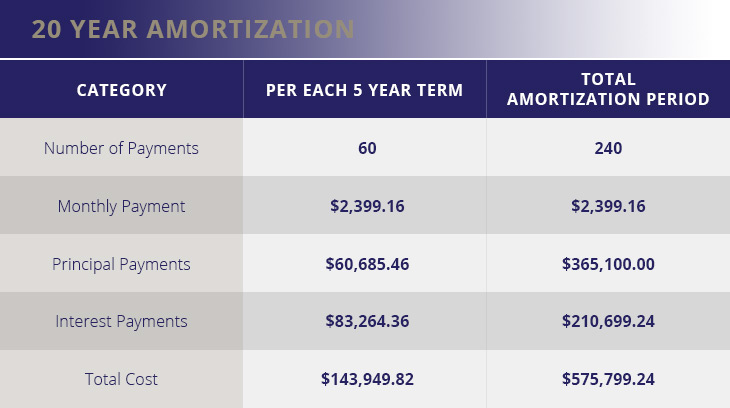

Let’s Compare the Same House/Mortgage But With Different Amortizations

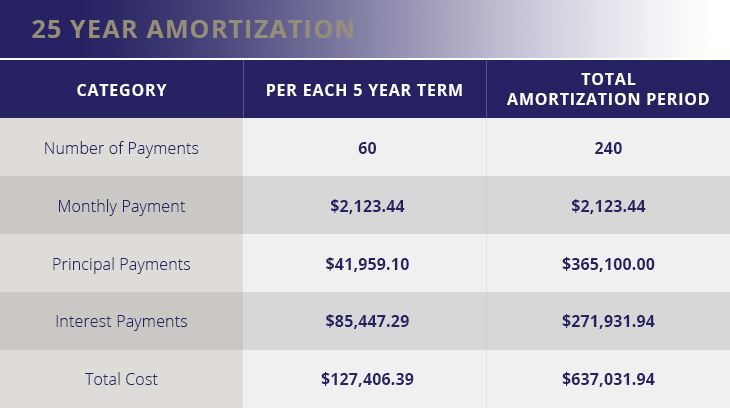

The median selling price for a detached home in Calgary so far in 2019 is $456,375, so we will use that number for our example and calculate our monthly payments and overall total cost using the Government of Canada’s mortgage calculator. We will also assume a 5.00% interest rate, and a 20% down payment of $91,275 and assume that we are making 12 payments per year. All examples are calculated using terms of 5 years at a time.Please note that if you choose a variable rate mortgage, your interest rate will likely change throughout the term of your mortgage.

As you can see in the example, the difference between a 5-year amortization period and a 25-year amortization period is significant. While a 25-year mortgage allows you to pay $2,123.44 per month, which is $4,757.86 less per month than with a 5-year mortgage you also end up paying $224,153.36 more for the same house if you choose to spread your mortgage over 25 years.

So, Which Option is Best For You?

Everyone’s financial situation is different, so that means that the only way to really know which mortgage is best for you is to sit down and run the numbers. A mortgage broker will review your financial situation with you and help you decide which option is best suited to your unique situation and needs.

We are here to help you find the best mortgage to suit your needs. Let’s get started.

References

https://mortgage.rbc.com/pdfs/62376_FS_28852_0311_Longer_or_shorter_Eng.pdf

https://www.ratesupermarket.ca/blog/shorter-vs-longer-mortgage-amortization/

https://itools-ioutils.fcac-acfc.gc.ca/MC-CH/MCCalc-CHCalc-eng.aspx

https://www.investopedia.com/mortgage/mortgage-rates/payment-structure/

https://www.investopedia.com/articles/personal-finance/051914/mortgage-amortization-strategies.asp