Many Canadians dream of owning their own home, but with an increasingly competitive housing market and the rising cost of living, many find that dream might be beyond their reach.

To help middle-class Canadians purchase either their first home or a home for a relative with a disability, the Government of Canada has the Home Buyer’s Plan (HBP).

What is the New Federal Home Buyer’s Plan?

As part of the New Federal HBP, the federal government is introducing the CMHC First-Time Home Buyer Incentive, which aims to reduce the amount of money middle-class families need to borrow for a mortgage without increasing the cost of a down payment.

The First-Time Home Buyer Incentive is designed to provide funding for between 5% and 10% of a home’s purchase price. If you are purchasing an existing home, this new program will cover 5% of your mortgage, and if you choose to build a new home, it will cover 10%. The larger incentive for newly built homes helps to increase Canada’s currently limited housing supply.

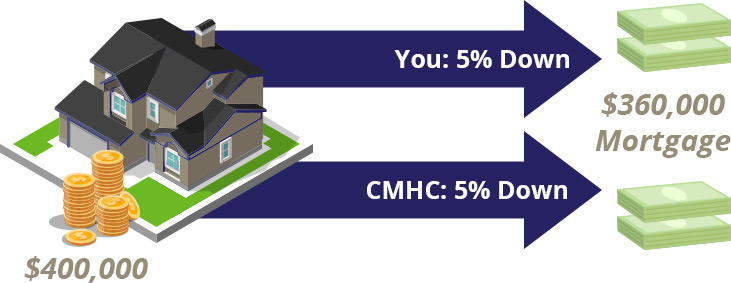

For example, if you are looking to purchase a $400,000 home with a 5% down payment as well as a 5% CMHC shared equity mortgage (worth $20,000) then instead of needing to take out a mortgage for $380,000 you would only need a $360,000 mortgage.

This incentive is paid out monthly, reducing your monthly mortgage payments and freeing up more funds to pay down your mortgage more quickly or meet other pressing needs.

Selling Your Home

If you choose to sell the home you purchased with the help of the CMHC First-Time Home Buyer Incentive the funds provided to you by the program will have to be repaid as part of the sale.

How Does it Compare to the Existing RRSP Home Buyer’s Plan?

The existing RRSP Home Buyer’s Plan is designed to help with the down payment and associated costs of purchasing your first home. Under the current plan, a first-time home buyer can withdraw up to $25,000 from their RRSP to either purchase or build their first home. If two people wish to purchase a home together, they can both withdraw up to $25,000, giving them a combined amount of $50,000 to put towards their down payment.

The government of Canada plans to increase the eligible withdraw amount from $25,000 to $35,000 each under the 2019 federal budget. This new criterion applies to withdraws made after March 19, 2019.

The CMHC First-Time Home Buyer Incentive is designed to reduce your monthly mortgage payments by covering between 5% and 10% of the cost of your new home, while the RRSP Home Buyer’s Plan allows you to withdraw money from your RRSP to use for the downpayment on your home.

How You Can Take Advantage of the New CMHC Home Buyer’s Plan

To ensure that this plan is helping first-time homeowners who may not otherwise be able to purchase a home, this new program requires that you be:

- A first-time home buyer, a person with a disability, or a person helping a relative with a disability buy or build a qualifying home. A first-time homebuyer is defined as someone who, in the last four years, has not occupied a home that you or your current spouse or common-law partner owns. The four year period begins on January 1st of the fourth year before the year you plan to withdraw the funds and ends 31 days before the date you withdraw the funds. If you are not currently considered a first-time homebuyer, you may be considered one later once the four year period has passed.

- You must have a written agreement to buy or build a qualifying home for yourself or to buy or build a qualifying home for a related person with a disability or to help a related person with a disability buy or build a qualifying home. A pre-approved mortgage does not satisfy this condition.

- You must intend to occupy the qualifying home as your principal place of residence within one year after the home is built or bought. If you are purchasing or building a qualifying home for a related person with a disability, or helping that relative build or buy a qualifying home, you must intend for that person to occupy the qualifying home as their principal place of residence.

Your combined household income must also be below $120,000 per year.

To find out if you and your spouse or common-law partner qualify for the RRSP Home Buyer’s Plan you can check your eligibility here.

Your mortgage broker can help you determine if you and your spouse or common-law partner are eligible for the new CMHC Home Buyer’s Plan and the RRSP Home Buyer’s Plan.

You can access the details, and easy to understand examples of how this incentive can be used, here:

https://www.placetocallhome.ca/fthbi/first-time-homebuyer-incentive.cfm